Advanced

Sonora Lithium Royalty

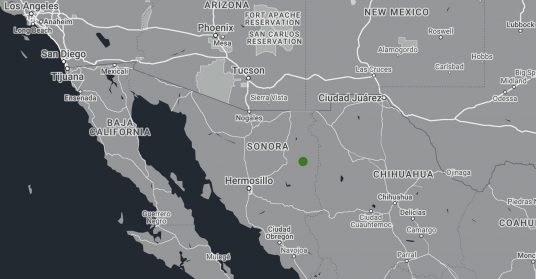

Trident holds a 50% interest in Sonoroy Holdings which has the right to acquire a 3% GRR over the Sonora Lithium Project in Mexico for US$52M in cash (US$26M attributable to Trident for 1.5% GRR).

Advanced

Trident holds a 50% interest in Sonoroy Holdings which has the right to acquire a 3% GRR over the Sonora Lithium Project in Mexico for US$52M in cash (US$26M attributable to Trident for 1.5% GRR).

The Sonora Lithium Project contemplates a two-stage development pathway comprised of a Phase 20,000tpy lithium hydroxide operations followed by an increase to 50,000tpy of lithium hydroxide for Phase 2. Sonora is a shallow stratiform, volcaniclastic sedimentary hosted, lithium bearing polylithionite clay deposit with significant potential for mine life extensions beyond the initial 19-year plan.

August 2023

Ganfeng noted that Mexico had cancelled the licenses associated with the project claiming the historical minimum investment obligations had not been met. Ganfeng dispute this claim and have filed for an administrative review against the Mexican government regarding the cancellation of the lithium concessions.

February 2023

Mexican President Andres Manuel Lopez Obrador signed a decree handing over responsibility for lithium reserves to the energy ministry, after nationalizing lithium deposits last April.

September 2022

Ganfeng announced the intention to increase Phase 1 production to 20,000tpy lithium hydroxide and Phase 2 to 50,000tpy.

August 2021

China’s Ganfeng Lithium entered into a takeover transaction with Bacanora Lithium for £284.8M.

December 2017

A feasibility was completed for Sonora which outlined a mine producing 17,500tpy LCE in Stage 1 and 35,000tpy at Stage 2. The study estimated a pre-tax IRR of 26.1% and NPV@8% of US$1,253M.

| Location | Mexico |

|---|---|

| Operator | Ganfeng Lithium Group Co. Ltd |

| Commodity | Lithium |

| Mining Type | Open Pit |

| Stage | Advanced |

| Proven & Probable | 244Mt @ 3,479ppm Li |

|---|---|

| Measured & Indicated | 291Mt @ 3,251ppm Li |

| Inferred | 268Mt @ 2,652ppm Li |

| Total | 559Mt @ 2,959ppm Li |

Source: Capital IQ