Latest presentation

Trident Royalties Presentation

here to view the latest Trident Royalties Presentation

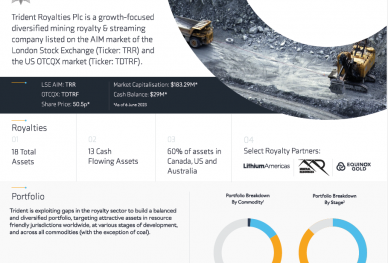

Trident Royalties Plc is a fast-growing diversified mining royalty company listed on the AIM market of the London Stock Exchange (Ticker: TRR) and the US OTCQB market (Ticker: TDTRF)

Trident is managed by an experienced team of mining finance professionals providing investors with exposure to the full breadth of mining commodities (excluding thermal coal) with a bias towards production or near-production assets. This commodity diversity differentiates Trident from the majority of its peers which are exclusively, or heavily weighted, to precious metals. Trident also has an international mandate, acquiring royalties and streams in resource-friendly jurisdictions worldwide…

Latest presentation

here to view the latest Trident Royalties Presentation

Latest media

Click here to view the latest Trident Royalties Media

Latest Factsheet

Click here to view the latest Trident Royalties Factsheet